Lithium-ion batteries will be critical over the first half of this century for both grid resiliency and electrified transportation across the world. Thus, the future of the electric grid is dependent on the continued supply and cost reduction of these batteries. Mining the raw materials for lithium ion batteries at the scale of expected demand growth will be a monumental challenge. And it is one that KoBold Metals is looking to take on.

There are four primary metals that are critical to manufacturing lithium-ion batteries: lithium, nickel, cobalt, and copper. The current supply of these metals is being outpaced by their exponential growth in demand. It is estimated that we will need to mine about 11.2 million tons of lithium carbonate equivalent per year by 2050 – twenty times the current annual global supply as of 2021. Similar trends are true for nickel, cobalt, and copper as well.

But scaling global mining capacity for these metals is challenging. Finding metal deposits and beginning new mining operations is a slow and costly process. To make matters worse, these costs are actually increasing year on year because the more metal we extract, the deeper into Earth’s crust we have to search to find new deposits. These increased costs are having an impact on the industry. According to a recent study by Minex Consulting, over the last decade, the sector had spent USD$198 billion to find just USD$109 billion worth of metal value. To stay profitable and close the growing supply gap, the mining industry needs to find new ways to reduce its costs and increase its annual production. But to understand how this can be done, we need to better understand how the mining industry currently operates and where the most significant costs are coming from.

The mining industry can be broken down into three main sectors: exploration, extraction, and refinement. Exploration is the process of identifying and verifying ore deposits through a series of geophysical and geochemical tests. Once a site is identified by an exploration company, it’s typically purchased by an extraction company based on the size and properties of the deposit. Once the ore is mined, it is sent to a refinery to purify and sell the metals.

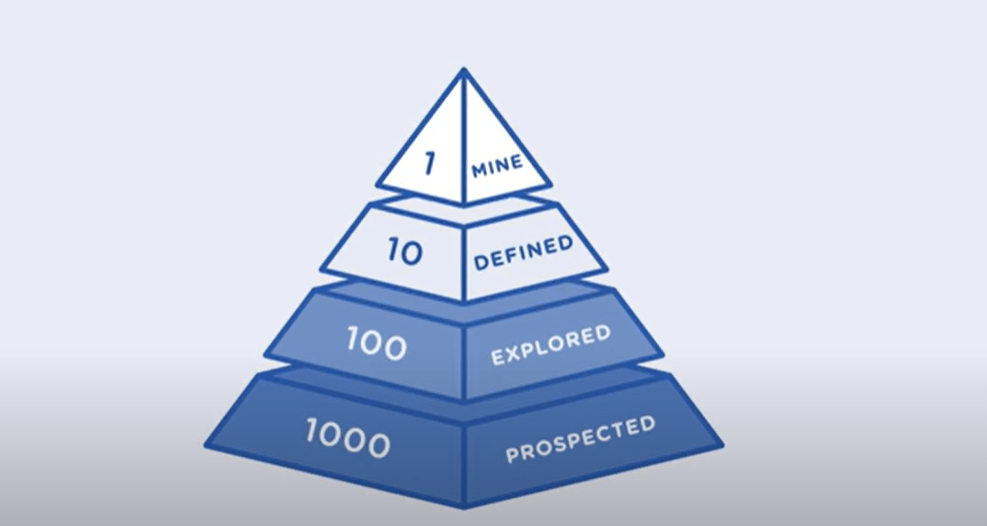

Of these three sectors, exploration is the least mature and most difficult to scale bcause of its inherent risk and unpredictability. Similar to venture capital firms, typical junior exploration companies cast a wide net by investing into several potential ore deposits in search of just a few viable mines large enough to recoup their overall investment. Exploration teams use a number of testing stages to determine the properties of different deposits and validate their value. The most common stages are mapping, geophysics, geochemistry, trenching, drilling, and analysis. Each of these stages is more costly and time-consuming than the last, but this sequential searching process allows exploration teams to narrow down their initial search to just a small set of well-defined mines without needing to break ground on each one. Still, a company’s investments can quickly pile up in search of just one profitable ore deposit. And if the company is cannot sell any of its investments, the large overhead costs can often be too large for the company to recover, resulting in bankruptcy.

Visual of how potential mining sites are explored, Credit: Sandstorm Gold Royalties

In the past, exploration was typically conducted by large, multinational mining companies with more capital runway to withstand temporary losses. During periods of flourishing, exploration projects became a prime investment opportunity. And during periods of economic downturn, they were often the first to be cut. But over the last few decades, many large mining companies have pulled out of the exploration sector to focus on the more safe business of extraction. This is in part due to the growing difficulty to make profits in the exploration business. And also because many extraction companies have been able to purchase mines with extraction periods on the scale of several decades, allowing them to simply profit from existing mines. But to meet the current supply gap, we need to find more mines.

Today, exploration is handled by smaller, junior companies that have been tasked with taking on the same large risks of the past but with less capital, only worsening the risks of the business model and the instability of the overall sector. For the mining industry to scale at pace with demand, the exploration sector needs to find ways to reduce their marginal costs and improve their success rate on investments. In other words, companies in the space need to develop more consistent and reliable methods to find and verify ore deposits. This is where companies like KoBold Metals enter.

Novel Methods from KoBold Metals

KoBold Metals, founded in 2018 out of Berkeley, California, is developing novel data science techniques to improve the success rate and cost investment of exploration projects. The company combines the long-standing expertise of geologists with bleeding-edge data science and artificial intelligence techniques and report being able to identify mines by about a factor of four times more often than the industry standard.

This marked improvement comes from a new sets of tools and approaches the team has developed at every stage of the exploration process. KoBold Metals’ first improvement comes from its comprehensive database called TerraShedSM. It compiles data from both public and private sources over the last century across Australia, Africa, and North America, incorporating everything from satellite and radiometric data to soil and rock profiles. By using higher-quality data from more sources, KoBold is able to create more detailed maps and make better predictions, giving them an edge over competitors in where metal deposits lie.

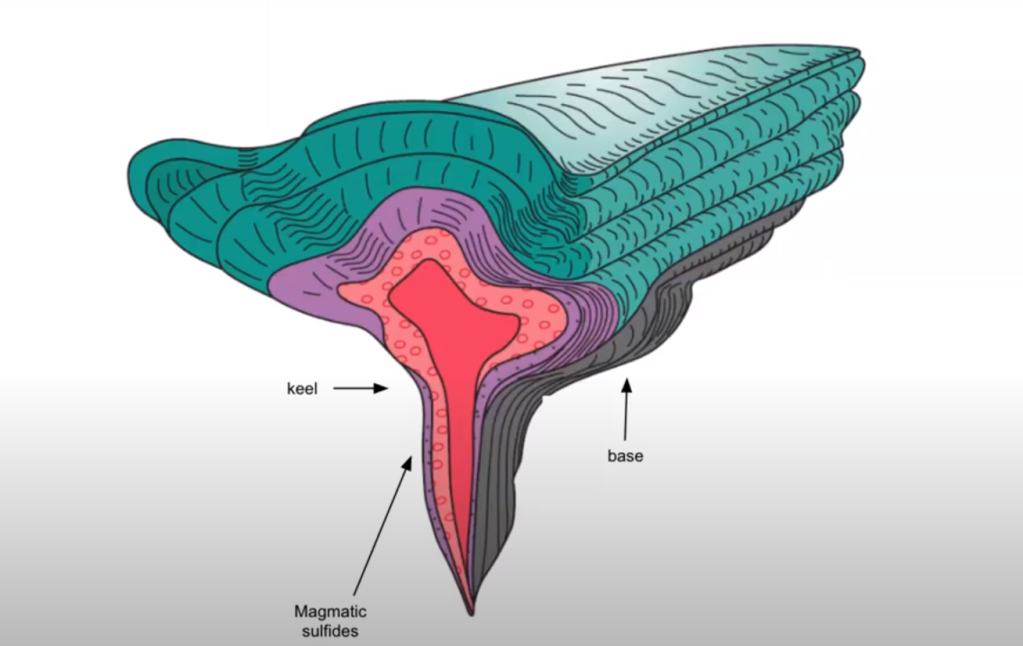

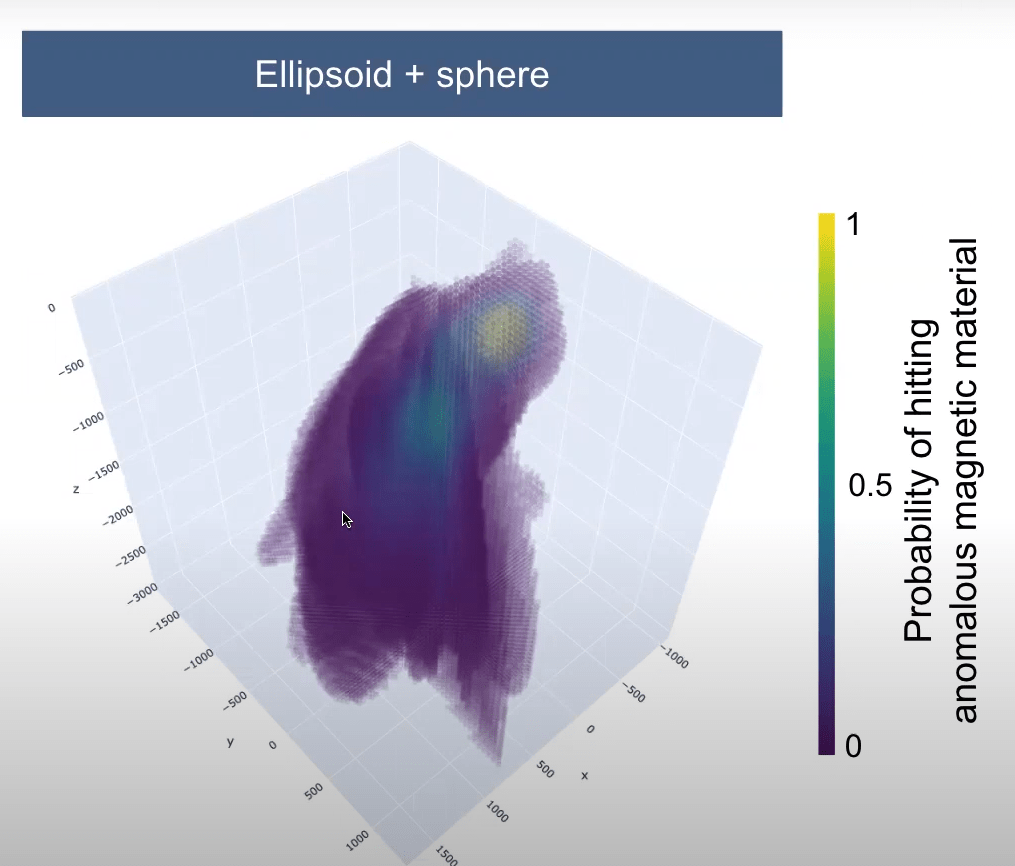

Diagram of mafic structure(top) and KoBold Metals model of mineral deposit(bottom)

All of this data is then used in with their proprietary suite of AI tools called Machine Prospector to help identify ore deposits. Similar to typical exploration processes, KoBold begins by developing detailed maps of a given region and looking for patterns in the geophysical structures and mineral composition of areas. For example, one of the areas that the KoBold team looks for is mafic structures, formed when magma is pushed out from deep in Earth’s crust. These structures often contain rare Earth metals and can be identified using radiospectroscopy. Once the KoBold team identifies a potential deposit, they develop a three-dimensional model for its shape. This model helps the team better predict an optimal angle at which to drill into the deposit to get an accurate sample of its contents. Each set of drill samples can cost on the order of a few million dollars and take days, so by making an accurate model of the deposit shape ahead of time, the team is able to reduce their capital and time investment on each potential mining site dramatically. Finally, to verify the types of metals within the structure, the team conducts a variety of tests on the deposit and the cores that they drilled from it. One of KoBold Metals’ tests is running eddy currents through the deposit structure and measuring its electrical conductivity. Because different metals have different electrical conductivities, this test allows the team to get a better understanding of the characteristics of the metals inside the structure without needing to begin extraction.

KoBold’s measured, systematic, and cost-effective exploration process has allowed them to find ore deposits in the same areas where other companies have not. The team recently found a untapped ore deposit in Zambia near an existing copper mine. The region was previously suspected to have little metal and thus not worth the cost of exploration, but KoBold’s better mapping and data analysis allowed them to take a risk and prove otherwise. This is indicative of the clear value KoBold is adding to the industry.

KoBold’s business strategy is also more forward thinking than other exploration companies. The company plans to hold onto the mineral rights of their properties and stay involved in the extraction process by partnering with larger mining companies like RioTinto and BHP. By contracting out their mines and holding onto their property investments, they can grow into a more robust firm with assets capable of surviving the natural risks of the industry in the long-term. This more sustainable business approach is consistent with their vision of surviving and growing with the demand for lithium-ion battery materials. I believe KoBold Metals is a promising company with an exciting future ahead and that their growth will make a critical contribution to the energy industry.

References:

https://www.greencarcongress.com/2022/10/20221015-benchmark.html